Mastering the Art of Reading Annual Reports

Unveiling the secrets that help you become a great manager and strategic leader.

What sets great Managers apart from the rest? Leadership skills and business acumen. Business acumen is a skill anyone can develop. If you want to lead a project, especially a large one, it helps to understand more than the project. You need to understand the business. This includes how the company makes money, the risks they face, and the financial and business language they use. This information can be learned by reading the company's annual report, and it's this business acumen that can elevate your decision-making and make you a valuable asset to your organization.

Business acumen refers to the ability to understand and interpret financial information, is more than just theoretical. It's a crucial skill that leaders, managers, and project managers can apply in their day-to-day decision-making. Financial data is pivotal in guiding the organization toward success, optimizing resource allocation, or aligning projects with strategic objectives. By mastering the art of reading annual reports, these professionals can gain a competitive edge and contribute significantly to their organization's success.

What is an Annual Report?

All public companies need to publish annual reports. These documents show past financial results and trends. In addition, they look forward to outlining the business strategy and direction. These aspirations often reflect projects the company must undertake to maintain growth, reach new markets, or create new products. Internal projects often reflect their goals to improve efficiency and effectiveness. Other goals may focus on projects to improve employees' or customers' experience.

Why do Project Managers need to read Annual Reports?

Business acumen, which refers to understanding and interpreting financial information, is more than just theoretical. It's a crucial skill that leaders, managers, and project managers can apply in their day-to-day decision-making. Financial data is pivotal in guiding the organization toward success, optimizing resource allocation, or aligning projects with strategic objectives. By mastering the art of reading annual reports, these professionals can gain a competitive edge and contribute significantly to their organization's success.

Managers need financial skills to plan their projects and interact with stakeholders. But projects don't exist in a vacuum. The company has goals, and so do investors. Companies share their business outcomes, stock performance, and underlying financials every quarter. Managers who learn to read a financial report and use that information can improve their chances for project success, personal growth, and future promotions.

Understanding past performance and future aspirations is key to ensuring your project is connected to the business goals and that you are mindful of the issues that senior management is concerned about. This information can help you discuss your project's benefits and risks in a way that resonates with your steering committee and senior product owners. You can better align the language used and link your project’s KPIs to the expected company performance. This will show insight into the bigger issues beyond your project.

Managers and project managers who want to learn how the business works will take time to review their annual reports. They understand this is a great way to understand how the company communicates externally to investors, customers, vendors, and their competition. Savvy managers understand Annual Reports are a way to uncover the secrets to communicating inside and outside their organization.

Deciphering annual reports isn't hard, but there are some basics you do need to understand. We'll also discuss what's important to review. You don't need to read the full document. However, understanding how the Annual Report is constructed and where you can find key data will help you quickly develop this skill. To make these concepts more tangible, we will use a real-world example based on a company we have all heard of - Starbucks.

Understanding how your company makes money could include knowing the product mix as in this Starbucks example.

What is in an Annual Report or 10K filing?

All publicly traded companies must final financial reports quarterly and yearly. If the company is traded on a US stock exchange, these reports are referred to as 10Q for quarterly and 10K for annual versions of the reports. The Annual report includes the data from the 10K but also includes a few other sections:

Management Discussion and Analysis (MD&A)

This section focuses on a summary of business results but also is a moment for management to define the company. Often, this may come across as a bit of an 'advertisement'—and it is. Companies value their brand and want to share the successes and key messages with their stakeholders. They may discuss past or current challenges to the organization, especially if they have had a bad year.

But MD&A is also a moment to look forward. It shares the goals and plans for the coming period. It tempers expectations while discussing potential threats to the organization. These threats are often risks within the organization and marketplace, but they often include large global issues that can impact the business.

Financial Statements

These key financial reports follow generally accepted accounting principles (GAAP). They are formatted to allow the reader to understand a standard format and data to quickly understand the results and compare them 'apples to apples.'

Notes to the Financial Statements

Since every company is unique in its strategies and management's approaches to decisions, companies support financial statement data with the details that back up its numbers. This includes the approach to how it makes money and how it calculated the details, the risks it took, the legal issues it addressed, and the cost of making good or bad decisions.

Corporate Governance

This section gives an overview of the three types of corporate governance. Governance is in place to protect the public investors and ensure the company makes reasonable decisions and follows procedures. A simplified summary of these groups is as follows:

The Company Officers. These are the CXOs who make the big strategic decisions for the corporation. Examples of CXOs are Chief Executive Officer (CEO) and Chief Operating Officer (COO); there are often around 10 of these senior management roles. It is helpful for managers to know who these people are since senior managers should execute plans according to the strategic plans coming from the CXO level.

The Board of Directors. This group of senior leaders from outside the company oversees the decisions at the CXO level. It provides guidance and oversight to confirm the company is meeting its obligations of fair and accurate reporting to the public.

The Auditors. Staff from an external company confirms the company has documented its financial statements and summary of the organization's business details correctly according to the general principles mentioned above.

What are Financial Statements?

Annual reports include various types of financial data, each providing unique perspectives on a company's past financial performance. These data points typically include:

Assets always equal Liabilities. Focus on changes that may impact your project. Are inventories going up or down? Are customer’s using their loyalty value cards more or less?

Balance Sheet: The balance sheet presents the company's financial position at a specific time, showcasing its assets, liabilities, and shareholders' equity. It provides insights into the company's liquidity, solvency, and overall financial health.

Examine the assets, liabilities, and shareholders' equity sections to read a balance sheet effectively. Look for trends, changes, and ratios that indicate the company's financial stability and growth potential. For example, analyze the current ratio (current assets divided by current liabilities) to assess short-term liquidity. Seek quotes from the management's discussion and analysis (MD&A) section of the annual report to gain additional context and insights.

The P&L can tell you if your company is making or losing money over time. The trend matters.

Income Statement (P&L): The income statement reveals a company's financial performance over a specified period. It outlines revenues, expenses, and profits, enabling readers to assess profitability, cost efficiency, and revenue growth.

Begin 'decoding' the P&L by analyzing the revenue and expense sections of the income statement. Identify revenue drivers, such as product lines or geographical segments, and assess their growth rates. Scrutinize expense categories to understand cost management strategies. Ratios like gross margin (gross profit divided by revenue) provide insights into cost efficiency and pricing power. Additionally, quotes from the CEO or CFO may shed light on the company's strategic initiatives and performance drivers.

How does your company make money? What are the growth trends (ie, investment or divestiture)?

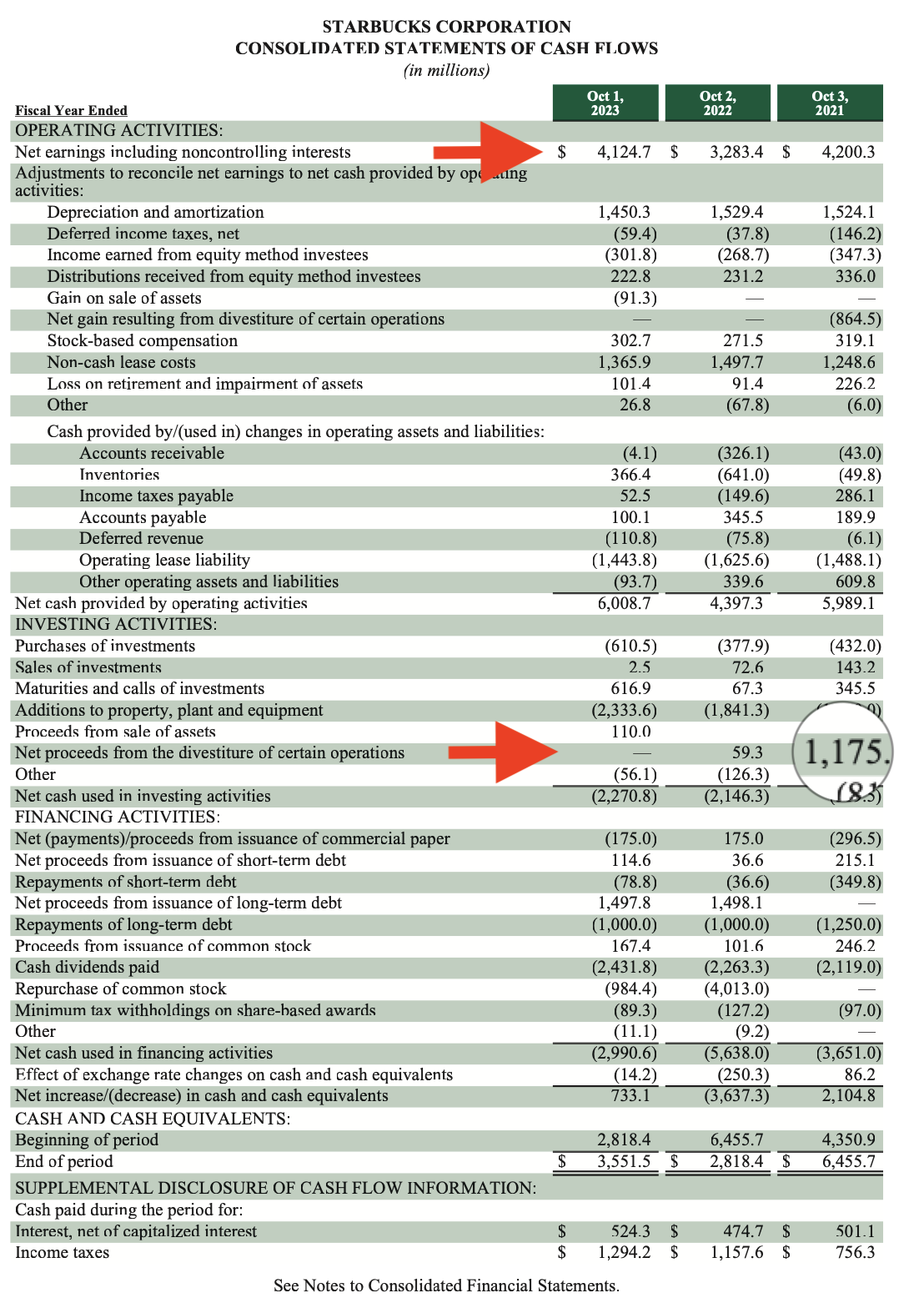

Cash Flow Statement: The cash flow statement tracks the inflow and outflow of cash within a company during a specific period. It illuminates a company's ability to generate and manage cash, providing insights into its liquidity, investments, and financing activities.

The cash flow statement reveals a company's cash generated and used during a specific period. Analyze the operating, investing, and financing sections to identify trends and evaluate the company's cash management practices. Assess the company's ability to generate cash from core operations and investment choices. Quotes from the CFO or financial notes can help explain changes in cash flow patterns and uncover potential red flags.

Reviewing Annual Reports for Strategy and Unearthing Buried Issues

Annual reports are not just financial statements, they are strategic roadmaps and risk maps. Look beyond the numbers and delve into the management's discussion and analysis, footnotes, and supplementary information sections. Pay attention to any shifts in strategy, competitive advantages, or industry challenges outlined by the management. Analyze the financial notes for any hidden issues, such as pending lawsuits, contingent liabilities, or changes in accounting policies that may impact future performance. By using annual reports as a strategic tool, you can feel more strategic and forward-thinking in your decision-making.

Savvy managers will look for connections to the past performance of the company and its future plans. These initiatives often create projects to implement processes, policies, or procedures. They may also be programs to build new products, open new marketplaces, or build new buildings or assets. Understanding how future projects relate to your current work is important. It can help you stay relevant and know if the landscape is changing. Your project may be in trouble if you have competition for funding or management attention. Linking your project to key results and outcomes can help your project get or keep the ‘green light and funding.’

Know your corporate economy

Another thing savvy managers understand is the link between the stock price and a company's market value. But managers should also keep an overview of what’s happening with competition, key customers, and suppliers. This helps them understand whether their company and projects are under pressure or ahead of the game. When stock prices drop, the company may retract, cancel projects, or lay off staff to improve financial performance and increase short-term market value. While this does not always work since many factors drive market value. But when companies are under pressure, the officers and the board feel the pressure to make changes to try to protect the brand and company, even for short-term changes.

Reading an annual report is valuable for leaders, managers, and project managers seeking to understand a company's financial health, performance, and strategy. By mastering the art of interpreting balance sheets, income statements, and cash flow statements, professionals can make informed decisions and contribute to their organization's success. Additionally, by thoroughly reviewing annual reports, stakeholders can uncover hidden issues and comprehensively view the company's prospects. Annual reports are not just numbers but a gateway to understanding the intricacies of a company's operations, financial position, and future potential. You can feel more informed and knowledgeable about your organization by understanding annual reports.

This article is part of a series on building business acumen and financial skills. Look for the rest of the series on why project managers need business acumen, key financial terms, project business governance, and how to present your business case with business acumen.